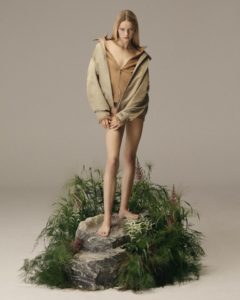

Image Courtesy – Burberry

British luxury brand Burberry intends to sell a sterling sustainability bond, to fund social and environmental improvements.

Burberry joins the trend of sustainable financing. The British luxury company is preparing a bond issue to finance or refinance its green projects. The company has applied to be rated by Moody’s and expects to obtain a Baa2 rating with a stable outlook.

This will be the first sustainability labelled bond issued by a luxury company and will diversify Burberry’s sources of funding, introducing long-term financing into the Company’s capital structure. Burberry has highlighted a focus on corporate responsibility, including animal welfare and sustainable cotton farming, as it seeks to win over socially conscious consumers and investors.

From their products to their packaging, Burberry has been building on their history of innovation and creativity to drive a positive change. The brand said it hopes to be carbon neutral by 2022, and is switching to renewable energy sources and working on reducing greenhouse gas emissions.

Image Courtesy – Burberry

The Burberry Foundation is an independent charity dedicated to using the power of creativity to drive positive change in global communities and build a more sustainable future through innovation.

Image Courtesy – Burberry

Burberry is thus following in the footsteps of other companies in the sector such as Prada , Moncler , Salvatore Ferragamo or the Spanish brand Camper , which in recent years have launched similar initiatives. Globally, the fashion industry is focusing more on the environment and sustainability amid consumer and regulatory pressure.