There are several trends that emerged in late 2018, trends that are likely to face the change of the luxury industry. Luxury went online with a vengeance. Luxury also got far more sustainable. And much more individualistic. Here are some trends that will find resonance in 2019 in a rather big way.

Green is the new black.

There are very valid concerns about climate change, environmental sustainability, and the way we treat animals. Each of these is affecting how luxury is bought and experienced. The market research company Mintel revealed that consumers are more likely to purchase ethical brands at a premium price.

Several luxury behemoths have already announced their decisions to eschew fur and exotic leather—from global luxury group Kering, which owns brands such as Gucci and Yves Saint Laurent, to Versace, Michael Kors, Giorgio Armani and Burberry, the list is long and still growing. The British Fashion Council went a step further by banning use of animal fur from every fashion show during London Fashion Week. “The luxury industry has a particular responsibility because it sets trends and is open to innovation,” Marie-Claire Daveu, chief sustainability officer for the Kering luxury group is reported to have said. “Sustainability should be at our core.” The Danish Fashion Institute has several tools to help brands clean up their practices, such as a library of sustainable fabrics—over 1,500 cloth samples, kept in Copenhagen—and a database of 100 sustainable fabric suppliers. The institute also has a sustainable-fashion shopping guide for Copenhagen and organizes fashion swap meets so consumers can recycle clothes.

BSR, one of the world’s largest non-profit business network, which is dedicated to sustainability, claims that, increasingly, luxury brands are making concern over environmental issues a part of their corporate responsibilities. But the focus is not just on animal abuse. For many brands, fashion’s green targets are cleaner fabrics (treatment is often chemical-heavy), animal rights in leather production, production transparency, safer manufacturing conditions and worker rights and a proactive look at the impact of climate change on the industry.

A new study released by BSR and Kering says that climate change will negatively affect the availability and quality of key raw materials—and by extension, the vulnerable communities that are herding or farming these materials.

Sustainable communities

Living the wellness lifestyle

The true lovers of sustenance do not just live a more sustainable lifestyle. They are increasingly looking at moving into wellness communities. Wellness-lifestyle real estate may not be such a big trend right now, yet increasingly luxury developers and architects are discussing how the world needs them. These aren’t your regular luxe real estate: large mansions overlooking golf course and lavish spas.

These are communities living in real estate that is built on sustainable principles. Already, many luxury developers are creating residential complexes with large green spaces, access to farmers’ markets, spaces for socializing and coworking, and myriad indoor and outdoor fitness options. Katherine Johnston, a senior research fellow at the Global Wellness Institute in Miami, who has conducted a research on the trend along with fellow researcher Ophelia Yeung, calls it a nascent phenomenon, but one that will grow rapidly in the coming years.

Regenerative communities, in fact, will produce their own food and renewable energy, recycle their own water, and practice sophisticated waste-to-resource management that turns waste into tangible assets. In India, several complexes have begun recycling their garbage and use the biodegradable waste produced in gardens, or sell them to other complexes who can, in turn, use them to grow plants and nurture soil. In Almere, Netherlands, about 25 minutes east of Amsterdam, a pilot project of 203 energy-positive homes are being constructed that will provide easy access to pedestrian walkways, bike trails, and water for canoeing and kayaking, as well as yoga studios.

The rise of Wealthy Young Urbanites

A whole new category of consumer has emerged—Wealthy Single Urbanites (WSUs), with money to spend and virtually no dependents. They work hard and spend as much, and are driving the positive sentiment enveloping the luxury market today. After almost four years of suppressed growth, luxury is seeing some interesting movement. A Nielsen study, ‘Nielsen Insight 2018’ defines WSUs as tech-savvy, open to new experiences, with a preference for non-cash transactions. They peg WSU numbers at three per cent of the world population.

Buying on Instagram

In some markets, like the US, Instagram has a buy button through which people can buy luxury they see on a brand’s profile. India will soon join that league by early next year, when Instagram will add a buy button to its interface in India and first, direct them to the brand’s page, but soon will start selling directly. Buying through Instagram would mean a bonanza for global brands that have a very strong Instagram presence. A Bain & Co 2018 reports India as the second largest market for Instagram outside of US. A representative of Michael Kors, a popular bridge-to-luxury brand, says that they may soon launch their #InstaKors programme in India. After signing up on michaelkors.com with an email address and your Instagram handle, users can shop the brand’s looks featured on the social media platform. All they have to do is double click on the look with the #InstaKors hashtag and an email will be sent with the direct shopping link mentioned on the photograph.

Going beyond the ‘legacy’

Knot standard – Bespoke suiting

Once, luxury was all about legacy. That legacy earned a brand premium status and premium pricing over less pedigreed offerings. Today, no brand will be able to coast through only on the basis of being a legacy brand. Millennials and Generation-X see brand heritage of less relevance then what the brand means to their lives today. A Luxury Institute’s annual 2019 ‘State of the Luxury Industry’ survey, conducted across seven major markets (USA, UK, France, Italy, Germany, Japan and China) reveals that the new-age consumer rates brand heritage and history way below great quality, customer service, superior design, amazing craftsmanship, and exclusive products. While 41% of early-stage Chinese affluent consumers see brand heritage as a defining element of luxury, only 28% of seasoned Americans do so, while only a quarter of French and Italian connoisseurs feel heritage is important. Luxury brands can no longer continue to lean heavily on heritage without radically reinventing themselves to stay relevant.

Interior Define, custom made sofas

Internet and Instagram has ensured that people eschew the traditional route to access luxury that is far more individualistic. In markets such as Hong Kong, Singapore and Japan, mainstream luxury brands are losing their edge to smaller specialized brands that understand their customer better. Ready-to-wear is being replaced by made-to-order or bespoke. Some examples: Canada Goose’s protective warmth and cutting-edge style; luxury that delivers more value for the price. such as Knot Standard bespoke suiting; Luxury that is of great quality and is responsibly crafted, such as Interior Define custom-made sofas; luxury that is democratic and inclusive, like the Apple-Hermès watch; and luxury that is socially responsible, for example DeBeers’ Forevermark Diamonds being responsibly sourced and environmentally conscious.

The exponential growth in luxury experiences

The Louis Vuitton Series exhibition in London

A Nielsen ‘India Insight’ report reveals Wealthy Young Urbanite consumers put experiences far above purchases. Arjun Urs, Executive Director, Nielsen South Asia says, “Our study shows that the younger consumer is open to adventures and revolutionary ideas. And that includes women who are spending on travel and adventure sports.”

During a panel discussion titled ‘Exploring the Increasing Importance of Experience to the Most Sophisticated Buyers of Luxury Products and Services’, at the Italian Luxury Summit in November this year, several brands across different sectors talked about how exclusive experiences set brands apart for affluent.

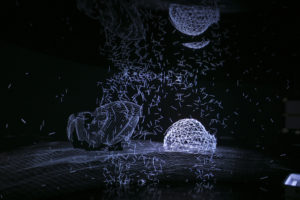

In the traditional sense, bricks-and-mortar locations continue to be centerpiece to the overall luxury experience, and offer consumers an opportunity to better connect to a brand’s story and heritage. Dempsey & Carroll’s New York flagship resembles a stationery museum and encourages sending of handwritten letters and notes. Bespoke stationery is a standout luxury, in fact, in the era of technology over-saturation. Louis Vuitton launched their Series exhibition, which allowed people to peer behind the scenes of a catwalk collection. The car, Mini, commissioned Mini Breathe installations during Milan Salone design week last year, where they showcased futuristic architectural structures that re-imaged challenges of urban planning.

Even restaurants and hotels have begun offering luxurious experiences such as food theatre, where diners are part of the cooking process or where you are part of a slow food experience—you help pick the ingredients from the restaurant or hotel’s farms, eat seasonal and help the chef cook your meal.

Clearly, simply buying stuff is no longer cool.